Key Issues

CBA of Kansas Top Priorities

Links & Resources

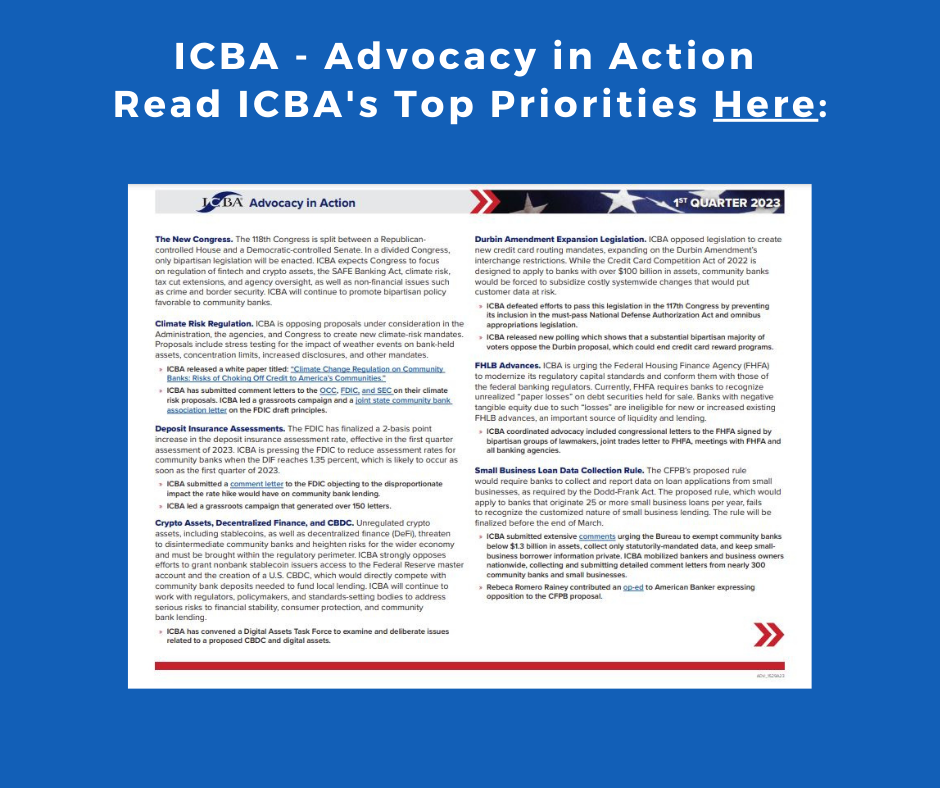

Read ICBA’s priority news here.

Media releases, images and more are available to share this message with your customers at the ICBA Plan Ahead page.

Media releases, images and more are available to share this message with your customers at the ICBA Plan Ahead page.

- Office of the State Bank Commissioner

- Federal Deposit Insurance Corporation (FDIC)

- Federal Reserve Bank of Kansas City

- Federal Financial

- Institutions Examination Council (FFIEC)

- FHLBank Topeka

- Independent Community Bankers of America(ICBA)

- Office of the Comptroller of the Currency (OCC)

- Securities and Exchange Commission (SEC)

Preserving Tax Cuts

ICBA will defend the 2017 tax cuts, including the 21 percent corporate rate, the individual rate, the deduction for passthrough income, current taxation of capital gains, and taxation of estates. ICBA will oppose changes to the taxation of “like kind” exchanges, limitations on IRA investments, and new taxes on Subchapter S business income.

New Bank Reporting of Account Holder Data

ICBA is opposing an Administration proposal to require financial institutions to report annually to the IRS on account inflows and outflows.

Climate Risk Regulation of Banking

ICBA is opposing proposals under consideration in the Administration, the agencies, and Congress to create new mandates regarding climate risk. Proposals include stress testing for the impact of weather events on bank-held assets, concentration limits, increased disclosures, and other mandates.

ICBA Anti-Credit Union "Wake Up" Campaign

Small Business Loan Data Collection Rule

Housing Finance

Trump-era amendments to the GSEs’ Preferred Stock Participating Agreements (PSPAs) included restrictions on the purchase of certain types of loans, with a disproportionate impact on smaller lenders.

Community Bank Leverage Ratio

ICBA is urging the banking agencies to extend the 8.5 percent Community Bank Leverage Ratio (CBLR) till the end of 2022 to accommodate elevated deposit levels caused by stimulus payments. ICBA-endorsed legislation in the House (H.R. 6145) and Senate (S. 3409) would accomplish this.

SBA Direct Lending

Support for Agriculture

Stablecoins

REAL RESULTS FOR YOUR BANK

Stopped Advance of IRS Reporting